Explore the latest offers and exciting credit cards from Dubai First

Save Big. All Year.

Unlock exclusive savings with your Dubai First credit card – all year long!

Explore more offers

Extended Privileges

There’s even more for you, in addition to all the great benefits you get with Dubai First, you can also enjoy:

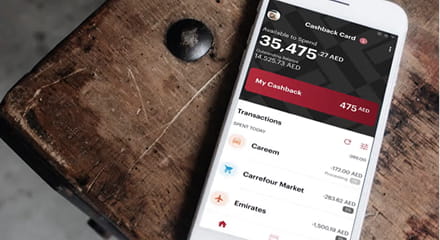

Apply for your Dubai First Card instantly on the Dubai First Mobile app.

The start to your mobile-first experience with the next generation credit card.

- Apply for your credit cards instantly.

- Enjoy an easy, seamless and intuitive experience.

- No paperwork. No in-person meetings required.

- All you need is your Emirates ID and IBAN.

Warning

If you make only the minimum repayment/payment each period, you will pay more in interest/profit/fees and it will take you longer to pay off your outstanding balance.

Still need more support?

Visit our dedicated Help and Support page for more, or reach out on:

| For inquiries | Existing customers within the UAE |

|---|---|

| 800 33 | 600545500 |

| International Call | Email ID |

|---|---|

| +971 4 352 8228 | contactus@dubaifirst.com |